stamp duty malaysia calculator

The 2016 Budget brought changes to the stamp duty land tax SDLT rates payable by purchasers on freehold commercial property and leasehold premium transactions. ASB Unitholders Get Up to 700 sen Dividend.

Malaysia Realtors Home Facebook

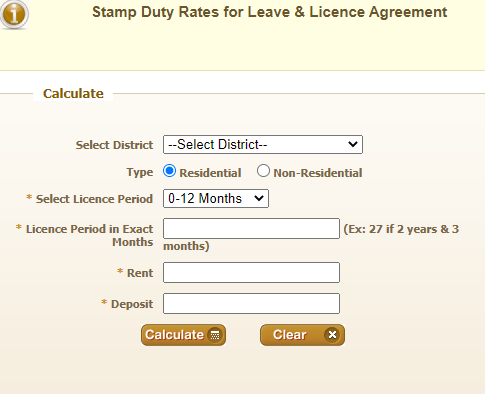

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

. However what you plan to do with the property also affects the amount youll pay. A new stamp duty calculator will allow first home buyers to work out the difference between paying stamp duty up-front or an annual land tax but the state government is yet to introduce. Stamp duty is the governments charge levied on different property transactions.

Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. After public consultation the government released a progress paper as an update on the proposal. Its calculated on a sliding scale so the more expensive the property the more stamp duty youll pay.

We hope this article brings you clarity about these topics Stamp Duty Malaysia Stamp Duty Exemption Stamp Duty Calculation. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Heres your guide to when a stamp duty tax deduction applies.

The stamp duty is free if the annual rental is below RM2400. Comparison Between Online Stock Broker in Malaysia. From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001.

For full repayment of the outstanding ASB Financing made within the first 2 years from the date of loan disbursement an exit fee as penaltycompensation to the bank based on the difference between the. Currently there are some circumstances where you may be able to avoid or reduce stamp duty such as being a. RM500 Billion In Debt Is The Malaysian Government Bankrupt.

If you have questions please dont be shy to reach out to us our contact number is 012. Currently first-time buyers are exempt from paying stamp duty along with anybody purchasing a property below 500000 in England. Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction.

Stamp duty on rental agreements. 1 on the unutilized portion of the overdraft facility for amount above RM250000 Exit Fee. Calculate the stamp duty you may have to pay on your property using our tool.

Read more about House Purchase in Malaysia. Stamp duty is a tax on big transactions such as property transfers. This Stamp Duty on MOT Calculator Stamp Duty Calculator Malaysia helps to estimate the total amount of Stamp Duty on MOT need to be paid.

Stamp duty is a standard part of buying a property and should be factored into your deposit. Genneva Gold Scam Explained. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016.

Liablebuyers are required to pay ABSD on top of the existing Buyers Stamp Duty BSD. When purchasing non-residential property in England or Wales you are still obliged to pay Stamp Duty Land Tax SDLT - a tax levied on property transactions and payable to Inland Revenue - on non-residential assets above the value of 150000 as it currently stands. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties.

The stamp duty is to be made by the purchaser or buyer and not the seller. The majority of property buyers will be required to pay stamp duty if the property price is above the threshold. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. Okay thats is 16 Questions about Stamp Duty Malaysia that most asked by you. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount.

Can owner-occupiers claim stamp duty. There is no stamp duty Tax applied to the first 250000. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Updated with the latest rates for September 2022 onwards. Calculate now and get free quotation. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary.

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. A full stamp duty exemption is given on. In November 2020 the NSW government announced plans to phase out stamp duty in favour of an annual property tax.

RM10 for Letter of Offer Commitment Fee. Stamp duty in Singapore is a type of tax that all homeowners must be familiar with. How to Open Trading and CDS Account for Trading in Bursa Malaysia.

Stamp duty is the tax you pay your state or territory government when buying a property. And we will see you in our next article. NSW Stamp Duty exemptions.

Under the reforms SDLT is now payable on the portion of the transaction value which falls within each tax band. ASW2020 Unitholders Get 60 sen Dividend for 2018. Also read all about income tax provisions for TDS on rent.

Purchasing and hunting for a house can be an exciting and stressful experience. These changes took effect from 17 March 2016. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Best Calculator for Property Stamp Duty Legal Fees in Malaysia Free. How to calculate the new stamp duty rate.

Use our Stamp Duty Calculator to find out how much SDLT Stamp Duty Land Tax may be payable on your residential property purchase in England or Northern Ireland. For some people buying a home is a significant milestone that tops many peoples lifetime to-do lists. The state government has a general rate of stamp duty which applies to investment property.

You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. Do I need to pay stamp duty on non-residential property. Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable.

Its important to remember as it can add tens of thousands to the size of your loan. ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property whichever is the higher amount. To know how much down payment lawyer fees and stamp duty needed are so.

Legal Fees Stamp Duty Calculation 2022 When Buying A House In Malaysia. Some Stamp duty is paid fully by buyer and some are shared between buyer and seller and some are fully covered by Developer different situation will be different. This is effected under Palestinian ownership and in accordance with the best European and international standards.

The cost of stamp duty depends on the value of the property. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. But remember if you are a first home buyer many States and Territories offer.

Northern Territory stamp duty guide and calculator.

Car Loan Calculator Malaysia Apk For Android Download

Stamp Duty Calculator Greater London Properties Glp

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Smart App Calculators For Lawyers In Malaysia Download Now Easy Law

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2022

Leave And License Agreement Stamp Duty Registration Format More

Home Loan Calculator Malaysia Stamp Duty Legal Fee Valuation Fee 2022 Property Malaysia

All You Need To Know About The Calculation Of Stamp Duty On Different Instruments Ipleaders

Loan Calculator House Sale 59 Off Ilikepinga Com

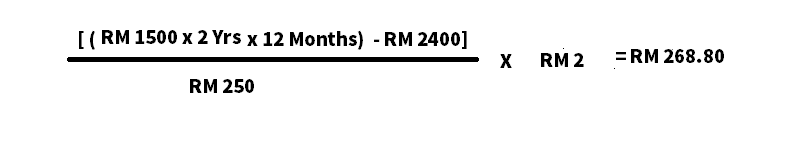

Employment Law Calculation For Payment Of Overtime Work Chia Lee Associates

Best App For Calculating Legal Fees And Stamp Duty In Malaysia

Financing Up To Rm150 000 Digital Personal Loan Alliance Bank Malaysia

Malaysia Stock Calculator Apps On Google Play

Ws Genesis E Stamping Services

Property Legal Fees Stamp Duty Calculator Malaysia

Buying Property And Stamp Duty Planning Action Real Estate Valuers

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Comments

Post a Comment